Market Overview

The Mexico Flat Glass Market Size reached a value of about USD 1090.11 Million in 2024. The industry is further expected to grow at a CAGR of 4.20% in the forecast period of 2025-2034 to attain nearly USD 1644.93 Million by 2034. The demand for flat glass in Mexico is driven by rapid urbanization, rising construction activities, and increasing adoption of energy-efficient glass products. The expansion of the automotive and solar energy industries also contributes to market growth. Innovations in glass production technologies, such as smart glass and coated glass, are further enhancing the industry’s development. Additionally, government initiatives promoting energy-efficient buildings and infrastructure projects are expected to support the demand for high-quality flat glass.

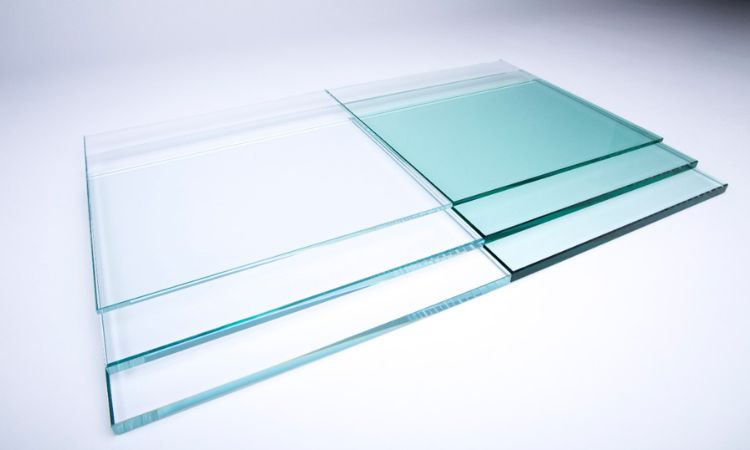

Market Segmentation: By Technology

Float Glass

Float glass is the most commonly used type of flat glass due to its versatility and cost-effectiveness. It is widely used in architectural applications, automotive manufacturing, and interior decoration. The process of producing float glass involves floating molten glass on a bed of molten tin, resulting in a high-quality, distortion-free product. In Mexico, the construction sector’s increasing demand for durable and aesthetic materials is expected to fuel the growth of float glass.

Sheet Glass

Sheet glass is a traditional form of flat glass that is still used in various applications, such as windows and picture frames. Though it has been largely replaced by float glass in modern construction, it remains relevant in specific applications where cost-effectiveness is a priority. The Mexican market for sheet glass is expected to witness moderate growth, primarily driven by demand from small-scale construction projects and low-cost housing initiatives.

Rolled Glass

Rolled glass is commonly used for decorative applications and industrial purposes. It is produced by passing molten glass through rollers that imprint patterns on its surface. This type of glass is preferred for privacy glazing, skylights, and textured glass panels. In Mexico, the growing preference for aesthetically appealing building designs is expected to boost the demand for rolled glass in the coming years.

Market Segmentation: By Product Type

Basic Float Glass

Basic float glass is a standard product used across various industries. It is a crucial material for residential and commercial construction, where it is utilized in windows, facades, and partitions. In the automotive industry, it is used for windshields and side windows. The increasing urbanization and industrial development in Mexico are key drivers of demand for basic float glass.

Toughened Glass

Toughened glass, also known as tempered glass, is strengthened through a heat treatment process to enhance its durability and safety. It is widely used in automotive applications, building facades, and furniture. The rising safety regulations and consumer preference for durable glass products are expected to drive the demand for toughened glass in Mexico.

Coated Glass

Coated glass features a thin coating of metal or other compounds to improve its energy efficiency and aesthetics. It is used in commercial buildings, solar panels, and high-performance windows. The Mexican government’s push for energy-efficient buildings and green construction practices is expected to drive the demand for coated glass.

Laminated Glass

Laminated glass consists of two or more glass layers bonded with an interlayer, providing enhanced safety and sound insulation. It is commonly used in automotive windshields, architectural glazing, and bulletproof glass. The increasing adoption of safety glass in high-rise buildings and automobiles is a major growth driver for laminated glass in Mexico.

Others

Other product types in the flat glass market include wired glass, mirrored glass, and decorative glass. These specialty glasses cater to niche applications in interior design, security, and customized construction projects.

Market Segmentation: By Raw Material

Flat glass manufacturing relies on raw materials such as silica sand, soda ash, limestone, and dolomite. The availability and cost of these raw materials significantly impact production costs. Mexico’s domestic supply of silica sand and other essential raw materials provides a competitive advantage to local manufacturers. The market is also witnessing a shift towards eco-friendly and recycled raw materials to reduce environmental impact.

Market Segmentation: By Category

Flat glass products are categorized based on their manufacturing processes and performance characteristics. Categories include annealed glass, heat-treated glass, and specialized glass. The growing demand for high-performance glass, including self-cleaning and electrochromic glass, is expected to shape the market’s future trends.

Market Segmentation: By Application

Architectural & Construction

The construction industry is the largest consumer of flat glass in Mexico. Increasing investments in commercial and residential projects, coupled with the demand for energy-efficient buildings, are driving market growth. Glass facades, windows, and partitions are extensively used in modern architectural designs, contributing to the market expansion.

Automotive

Flat glass plays a crucial role in the automotive sector for windshields, side windows, and sunroofs. The growing automotive production in Mexico, driven by foreign investments and domestic demand, is expected to boost the demand for high-quality automotive glass.

Solar Energy

The increasing adoption of solar energy solutions in Mexico is driving the demand for specialized flat glass used in photovoltaic panels. The government’s focus on renewable energy initiatives and sustainability goals further supports this trend.

Electronics & Appliances

Flat glass is used in various electronic devices, including touchscreens, smart mirrors, and display panels. The rising consumer electronics industry in Mexico is contributing to the demand for high-tech glass solutions.

Others

Other applications include glass used in furniture, interior design, and transportation. The versatility of flat glass makes it an essential material across various industries.

Market Segmentation: By End Use

Residential & Commercial Buildings

The demand for flat glass in residential and commercial buildings is growing due to urbanization and rising disposable incomes. The shift towards sustainable and energy-efficient buildings is further boosting market demand.

Automotive Manufacturers

Mexico’s status as a leading automotive manufacturing hub is fueling the demand for high-quality automotive glass. Increased safety regulations and advancements in vehicle design are driving the adoption of laminated and tempered glass in automobiles.

Industrial & Manufacturing

Flat glass is extensively used in industrial applications, including machinery, processing plants, and high-tech manufacturing facilities. The expansion of Mexico’s industrial sector is expected to support market growth.

Others

Other end uses include aerospace, medical applications, and decorative installations. The continuous innovation in glass technology is opening new opportunities in these sectors.

Regional Analysis

The demand for flat glass varies across different regions in Mexico. Major urban centers such as Mexico City, Monterrey, and Guadalajara are key markets due to high construction activity and industrial development. The northern and central regions of Mexico have a strong presence of manufacturing facilities, while coastal areas are witnessing growth in tourism-related infrastructure projects.

Market Dynamics

Growth Drivers

Key drivers of the Mexico flat glass market include increasing urbanization, growth in construction and automotive sectors, and advancements in glass technology. Government incentives for energy-efficient buildings and renewable energy projects also contribute to market expansion.

Challenges

Challenges in the market include fluctuating raw material prices, regulatory constraints, and competition from alternative materials. The impact of economic fluctuations on construction and automotive industries can also influence market growth.

Opportunities

Opportunities lie in the development of smart glass, self-cleaning glass, and sustainable production practices. Increasing investments in infrastructure and technological advancements are expected to create new growth avenues.

Competitive Landscape

- Vitro, S.A.B de C.V

- Saint Gobain S.A.

- Guardian Glass LLC

- AGC Inc.

- Nippon Sheet Glass Co., Ltd

- Others

Read More Blogs:

Top 10 Global Silica Sand Companies | Rising Glass Industry Demand | 2025

Expert Market Research Explores the Top 10 Companies in the Global Sportswear Market