Before buying investment property in Florida, there are several important factors to consider. First, find a realtor who knows Florida’s specific real estate laws and market well since these rules vary by state. Taxes matter too, Florida’s property taxes tend to be lower than many states, but local council fees can add up, so make sure to check those carefully. Also, watch for community fees which cover maintenance of shared amenities like pools or gyms and can start at about $200 monthly. Location is key: coastal cities often have high demand but northern areas may be less pricey with less renter interest. Check the property’s condition thoroughly because Florida homes can have special construction concerns and insurance limits related to natural disasters. Confirm rental permits if planning short-term leases, especially in Miami-Dade County where licenses are required. Lastly, non-residents should prepare for extra challenges like mortgage access and tax withholding on sales while seeking expert advice to avoid surprises later on.

1. Choose a Realtor Experienced in Florida Real Estate

Real estate laws and market conditions vary widely from state to state, and Florida has its own unique set of rules and trends. Working with a realtor who is licensed and experienced specifically in investment property for sale in Florida is crucial. These agents have a deep understanding of local zoning laws, tax regulations, and property types that you won’t find elsewhere. They can access Florida’s Multiple Listing Service (MLS), giving you a comprehensive view of available properties. An experienced Florida realtor can spot title issues or legal red flags early, helping you avoid costly surprises. They also know neighborhood trends and can advise you on areas with strong rental demand or growth potential. Because Florida has special considerations like flood zones and specific insurance requirements, a local agent can guide you through these complexities. They’re familiar with community restrictions and homeowners association rules that might affect your investment. Additionally, Florida realtors often have trusted connections with local inspectors, attorneys, and insurance providers, streamlining the buying process. Choosing a knowledgeable Florida realtor minimizes risks, ensures compliance with state laws, and helps secure a fair price based on current market conditions.

2. Understand Florida Property Taxes and Local Council Fees

Florida’s property tax rates are generally lower than in many other states, averaging around 0.8% in popular resort areas. However, these rates can vary depending on the county, as local taxes fund infrastructure and public services like schools and roads. It’s important to check the specific tax rates for the county where you plan to buy, which can be confirmed through the county property appraiser’s website or local tax offices. Before purchasing, review the property’s past tax payment history to ensure there are no unpaid liens or back taxes that could become your responsibility.

Keep in mind that Florida offers homestead exemptions that reduce tax liability, but these only apply if the property is your primary residence. Investment properties do not qualify for this exemption, so expect a higher tax bill compared to owner-occupied homes. Additionally, school district taxes and municipal fees may add to the overall property tax, and some counties impose special assessments for improvements such as road repairs or stormwater management.

Tax bills are usually sent out in November, with some counties offering discounts for early payment. For non-resident investors, consulting a tax professional is advisable to understand any specific tax implications, including how local fees and assessments might affect your investment returns.

3. Check Additional Utilities and Community Maintenance Costs

When buying investment property in Florida, it’s important to carefully review any additional community fees that come with the property. These fees typically cover maintenance of shared amenities such as pools, gyms, landscaping, and security. Monthly community fees often start around $200 but can rise significantly if the community offers luxury services or extensive upkeep. Make sure you understand exactly which services are included in the fees to avoid unexpected costs. Besides regular fees, some communities may charge special assessments for major repairs or upgrades, which could be substantial and impact your budget. Utility costs like water, electricity, and waste disposal may be included in these fees or billed separately, so clarify this upfront. Reviewing recent community meeting minutes can give insight into upcoming projects or fee increases. It’s also wise to ask about the HOA’s reserve funds, as a healthy reserve helps cover unexpected expenses without sudden fee hikes. Check if the homeowner’s association is involved in any pending lawsuits or financial troubles, as these issues can affect your investment. Additionally, if you plan to rent the property short-term, verify the community’s rules and any related fees or restrictions. Finally, understand the payment schedules for community fees and any penalties for late payments to avoid surprises that could complicate your finances.

- Community fees cover maintenance of shared amenities like pools, gyms, landscaping, and security.

- These fees can vary widely, starting around $200 per month, and may increase with luxury services.

- Understand exactly what services are included in the monthly fees to avoid surprises.

- Some communities charge special assessments for major repairs or upgrades, which can be substantial.

- Utility costs such as water, electricity, and waste disposal might be included or billed separately.

- Review recent community meeting minutes to learn about upcoming fee changes or projects.

- Ask about reserve funds the association holds to cover unexpected expenses.

- Check if the homeowner’s association (HOA) has any pending lawsuits or financial issues.

- Know the rules about short-term rentals within the community, as fees or restrictions may apply.

- Verify payment schedules and penalties for late payments to avoid financial complications.

4. Evaluate the Area for Demand and Property Value Growth

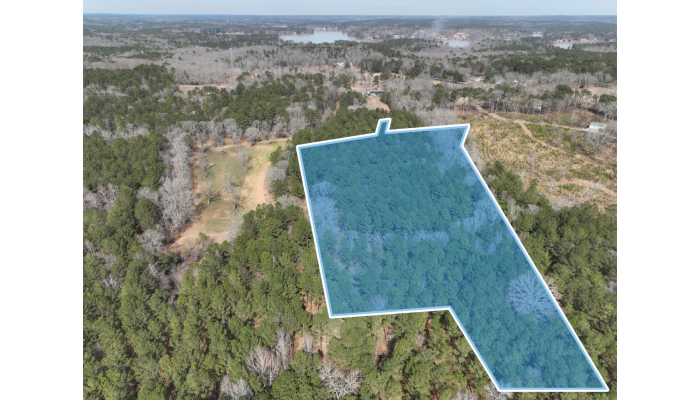

When considering an investment property in Florida, carefully evaluate the neighborhood for rental demand and potential appreciation. Waterfront properties and condos in Miami, Miami Beach, and Fort Lauderdale consistently attract strong rental interest, partly due to their proximity to beaches, entertainment, and transportation hubs. These areas have seen median condo prices grow about 20% annually in recent years, reflecting solid value growth. In contrast, northern Florida markets usually offer lower property prices but less rental activity, mainly because of the cooler climate and fewer amenities. Avoid properties priced significantly below market value unless you can clearly identify and fix defects or issues. Also, research local factors like crime rates, school quality, and employment opportunities, as these influence neighborhood stability and tenant demand. Check occupancy rates and average rents for similar properties nearby to gauge the rental market’s strength. Keep an eye on future developments or zoning changes that might affect property values, and consider risks like hurricanes, which can impact insurance costs and demand. Areas with planned infrastructure improvements may offer better appreciation prospects over time.

5. Inspect Property Condition and Natural Disaster Insurance

Florida homes are often built with lightweight materials to suit the warm climate, but this can affect the property’s durability over time. It’s important to thoroughly inspect the construction quality and look for signs of water damage or mold, which are common issues in humid environments. Check if the property includes hurricane-resistant features like impact-resistant windows, as these can reduce damage during storms. Single-family homes may face challenges securing natural disaster insurance, so verify insurance availability and coverage before buying. Request full inspections covering electrical, plumbing, roofing, and HVAC systems to avoid costly surprises. Consult insurance providers early to understand premiums, especially if the property lies within a flood zone, which requires separate flood insurance. Coastal locations might also need windstorm insurance, which can be expensive or limited in availability. Consider the property’s age and any previous storm damage; ask for maintenance records and disclosures about past repairs or insurance claims to get a clearer picture of potential risks and costs.

6. Verify Rent Permits and Short-Term Rental Regulations

Before buying an investment property in Florida, especially in Miami-Dade County, it’s crucial to verify rent permits and understand short-term rental regulations. Miami-Dade requires a short-term rental license that costs about $136 and typically takes around 10 days to process. This fee mainly covers inspection services to ensure the property meets safety standards. However, regulations vary widely depending on the city or residential community. Some communities have stricter rental limits or even prohibit short-term rentals outright. Local and county ordinances often specify minimum rental durations and maximum occupancy limits, so be sure to review these rules carefully. Additionally, many permits require annual renewal, which involves submitting updated documentation and possibly additional inspections. Failing to follow these rules can lead to fines, legal trouble, or losing the right to rent out your property. Since some cities have registration rules separate from county permits, check both levels of authority. To avoid surprises, ask your realtor or contact local government offices about any recent changes in rental regulations. Planning ahead to secure all necessary permits can prevent interruptions in rental income and ensure your investment complies with Florida’s evolving rules.

7. Know Rules for Non-Residents Buying Property in Florida

Non-residents have the same rights as U.S. residents when buying property in Florida, meaning no visa or physical presence is required. You can complete the entire transaction remotely using local real estate agents, lawyers, and electronic document signing. However, obtaining a mortgage can be tougher for non-residents since many lenders ask for larger down payments or require cash purchases. When selling, non-resident sellers are subject to a 15% withholding tax under FIRPTA, which the buyer withholds from the sales price. It’s essential to consult a tax advisor to understand income tax, capital gains tax, and estate tax implications related to your investment. Also, foreign nationals should consider currency exchange risks when transferring funds into the U.S. To protect your investment, secure title insurance and work with legal counsel to ensure clear ownership and full compliance with regulations. Be aware of IRS reporting requirements for rental income, and check if any additional state disclosure or filing rules apply to foreign buyers. Finally, plan ahead for property management and maintenance since handling these remotely can be challenging but is crucial for preserving your investment’s value.